Filed under: Investing

Medtentia International and clinicalprojects international Tap BioClinica for Express EDC, Data Management, and Centralized Imaging Reads

International Experience, Flexibility, and Speed to Support Innovative Cardiac Device Research

NEWTOWN, Pa.--(BUSINESS WIRE)-- BioClinica®, Inc. (NAS: BIOC) , a global provider of clinical trial management solutions, today announced an agreement for BioClinica Express EDC, data management, and imaging core lab services with Finnish company Medtentia International, in partnership with the contract research organization (CRO) clinicalprojects international (CPI). Medtentia International Ltd. is a medical technology company which develops solutions for mitral valve repair based on its proprietary helix ring concept. Medtentia's technology has the potential to reduce the invasiveness, operation time and morbidity associated with mitral valve repair operations.

Medtentia is the latest European customer to select BioClinica eClinical and Imaging Core Lab offerings. BioClinica services will support Medtentia's multi-country, multi-year study of a medical device for mitral valve (heart) repair. "We awarded this clinical trial to CPI and BioClinica based on the excellent feedback we received from their reference clients," commented Olli Keranen, CEO of Medtentia. "We were already familiar with BioClinica's Imaging Core Lab solutions and wanted to outsource EDC and DM to a stable global eClinical vendor. We are confident that both companies' reputations for customer focus and respective strengths will well serve the needs of an innovative medical device company like Medtentia."

Based in Bonn, Germany, CPI is focused on the planning and execution of Phase I-IV as well as post-marketing studies for innovative medical devices, combination products and (Bio)Pharmaceuticals. "We are delighted that Medtentia has entrusted us with their trial and look forward to another successful collaboration with the BioClinica team," said Jörg Breitkopf, Managing Director of CPI. "BioClinica has a strong service and technology reputation among medical device companies. Our partnership will provide Medtentia with the utmost in clinical trial support."

"BioClinica's fresh and more cost-efficient approach to clinical trial support is currently driving unprecedented sponsor and CRO partnership growth across both eClinical and Imaging Core Labs solutions," said Mark Weinstein, CEO of BioClinica. We continue to expand our team, especially in Europe, adding to our experience and global reach, and are pleased to have been selected to help support this important cardiac device research."

Follow BioClinica on the Trial Blazers blog at http://info.bioclinica.com/blog, and on twitter at http://twitter.com/bioclinica.

About Medtentia International Ltd Oy

Medtentia International Ltd Oy is a clinical-stage medical technology company developing novel mitral valve therapy products based on the company's proprietary helix technology. The company, based in Helsinki, Finland, is backed by leading Nordic venture capital funds. Additional company information can be found at www.medtentia.com.

About CPI

clinicalprojects international GmbH provides professional CRO services for manufacturers of medical devices, combination products and biopharmaceuticals. Since CPI's foundation in 2007, clients have turned to it for a range of clinical research support from the completion of individual tasks to full-project outsourcing. CPI has been involved in numerous medical device studies in various indications, most recently in cardiology, neuromodulation and pain. See more at http://www.clinicalprojects.de.

About BioClinica, Inc.

BioClinica, Inc. is a leading global provider of integrated, technology-enhanced clinical trial management solutions. BioClinica supports pharmaceutical and medical device innovation with imaging core lab, internet image transport, electronic data capture, interactive voice and web response, clinical trial management and clinical supply chain design and optimization solutions. BioClinica solutions maximize efficiency and manageability throughout all phases of the clinical trial process. With over 22 years of experience and more than 2,500 successful trials to date, BioClinica has supported the clinical development of many new medicines from early phase trials through final approval. BioClinica operates state-of-the-art, regulatory-body-compliant imaging core labs on two continents, and supports worldwide eClinical and data management services from offices in the United States, Europe and Asia. For more information, please visit www.bioclinica.com.

Certain matters discussed in this press release are "forward-looking statements" intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. In particular, the Company's statements regarding trends in the marketplace and potential future results are examples of such forward-looking statements. The forward-looking statements contained in this press release are based on our current expectations, and those made at other times will be based on our expectations when the statements are made. The forward-looking statements include risks and uncertainties, including, but not limited to, the consummation and the successful integration of current and proposed acquisitions, the timing of projects due to the variability in size, scope and duration of projects, estimates and guidance made by management with respect to the Company's financial results, the demand for our services and technologies, growing recognition for the use of independent medical image review services, trends toward the outsourcing of imaging services in clinical trials, realized return from our marketing efforts, increased use of digital medical images in clinical trials, expansion into new business segments, backlog, critical accounting policies, regulatory delays, clinical study results which lead to reductions or cancellations of projects, and other factors, including general economic conditions and regulatory developments, not within the Company's control. The factors discussed herein and expressed from time to time in the Company's filings with the Securities and Exchange Commission could cause actual results and developments to be materially different from those expressed in or implied by such statements. The forward-looking statements are made only as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstance. You should review the Company's filings, especially risk factors contained in the Form 10-K and the recent Form 10-Q.

BioClinica, Inc.

Company Contact - Jim Dorsey

267-757-3040

or

Diccicco Battista Communications

Trade Media - Morgan Dub Karpo

484-342-3600

or

Porter, LeVay & Rose, Inc.

Investor Contact - Michael Porter

Financial Media - Bill Gordon

212-564-4700

KEYWORDS: United States North America Pennsylvania

INDUSTRY KEYWORDS:

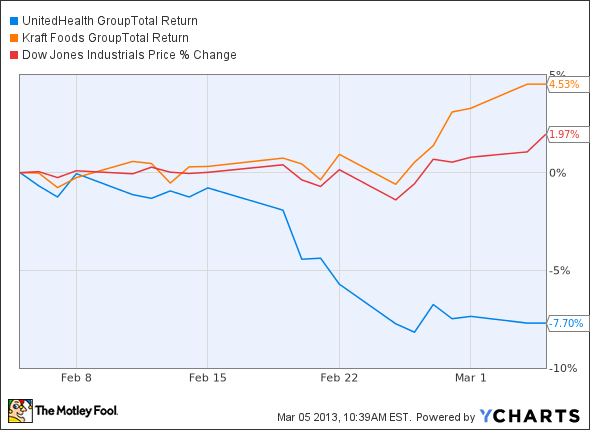

The article Medtentia International and clinicalprojects international Tap BioClinica for Express EDC, Data Management, and Centralized Imaging Reads originally appeared on Fool.com.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

Read | Permalink | Email this | Linking Blogs | Comments